How much does Medicare Part B cost?

Some people automatically get Medicare Part B (Medical Insurance), and some people need to sign up for Part B. The amount you pay monthly can vary depending on your income, and if you don’t sign up for Part B when you’re first eligible, you may have to pay a late enrollment penalty. (See bottom of post for Late Enrollment Fee example)

Part B Premiums

You pay a premium each month for Part B. Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these:

- Social Security

- Railroad Retirement Board

- Office of Personnel Management

If you don’t get these benefit payments, you’ll get a bill.

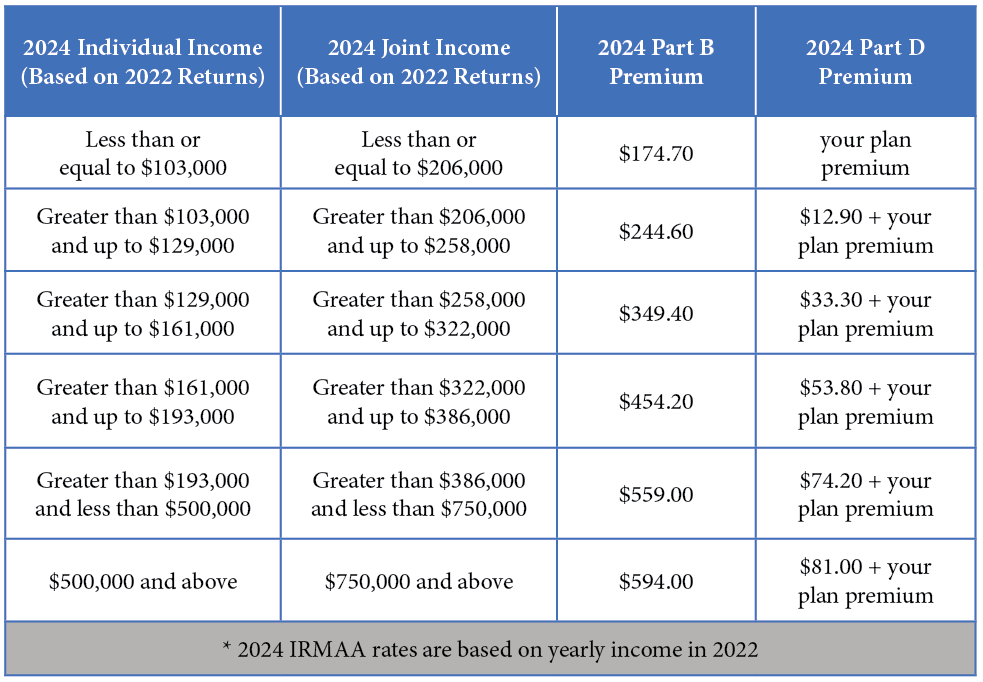

Most people will pay the standard premium amount. If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago. This is the most recent tax return information provided to Social Security by the IRS.

The standard Part B premium amount in 2024 is $174.70. Most people will pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you’ll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

Part B deductible & coinsurance

You pay $240 per year in 2024 for your Part B Deductible. After your deductible is met, you typically pay 20% of the Medicare-approved amount for these:

- Most doctor services (including most doctor services while you’re a hospital inpatient)

- Outpatient therapy

- Durable medical equipment (DME)

If you want to compare costs of Original Medicare versus Medicare Advantage versus Medicare Supplement then read our post on “Comparing Medicare Out-of-Pocket Costs”

Part B late enrollment penalty

In most cases, if you don’t sign up for Part B when you’re first eligible, you’ll have to pay a late enrollment penalty. You’ll have to pay this penalty for as long as you have Part B. Your monthly premium for Part B may go up 10% for each full 12-month period that you could have had Part B, but didn’t sign up for it. Also, you may have to wait until the General Enrollment Period (from January 1 to March 31) to enroll in Part B.

Usually, you don’t pay a late enrollment penalty if you meet certain conditions that allow you to sign up for Part B during a Special Enrollment Period.

If you have limited income and resources, your state may help you pay for Part A, and/or Part B. You may also qualify for Extra Help to pay for your Medicare prescription drug coverage.

| Example Your Initial Enrollment Period ended December 2016. You waited to sign up for Part B until March 2019 during the General Enrollment Period. Your Part B premium penalty is 20%, and you’ll have to pay this penalty for as long as you have Part B. (Even though you weren’t covered a total of 27 months, this included only 2 full 12-month periods.) |

Have additional questions about Medicare Advantage, Medicare Supplement, or general Medicare questions? For more information, or to speak to a friendly, licensed agent contact us HERE.

Comments are closed.