Are you sure you’re Medicare customers are covered by credible prescription drug coverage? If they are currently on a Plan J Medicare Supplement, then they may not be covered and could be racking up ongoing monthly penalties.

Why is this?

In 2003, the Medicare Prescription Drug, Improvement, and Modernization Act of 2003 designated that all Medicare recipients must obtain a Medicare Part D Prescription Drug Plan (PDP). As a result, drug coverage associated with Plan J became non credible, rendering Plan J coverages identical to that of Medicare Supplement Plan F, and requiring Medicare recipients to acquire a PDP Plan or face increased penalties.

Here is a breakdown of options to switch Medicare Supplements and gain credible prescription coverage to stop incurring penalties.

- Switch Medicare Supplements and add a Part D Prescription Drug Plan: If they want to directly switch Medicare Supplement Plans out of the expired Plan J then they will be required to undergo underwriting. Any changes to their health and significant increase in age since starting Plan J will most likely cause an increase in their Medicare Supplement rates due to underwriting. They will also need to add a Part D Prescription Plan to gain credible coverage and pay monthly penalties for not having a credible PDP plan.

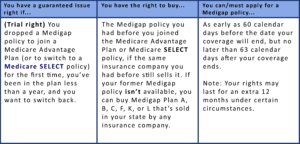

- Medicare Advantage Trial Right: If they have never been on a Medicare Advantage plan and currently have Medicare Supplement Plan J, they can get on Plan F via the Medicare Advantage trial right. Basically, Medicare allows recipients to try Medicare Advantage for the first time. They are given a 12 month period to “try” Medicare Advantage and if they decide to drop it before their trial period is up then Medicare allows them to go back on their existing Medicare Supplement insurance without underwriting. Since Plan J is no longer offered as a Medicare Supplement Plan, they will have Guaranteed Issue to the closest identical plan: Plan F. Plan F has essentially the same coverage as Medicare Supplement Plan J, but without the prescription coverage. They will also need to add a Part D Prescription Plan to gain credible coverage and pay monthly penalties for not having a credible PDP plan.

Source: Medicare.gov

It is important to note that whichever above route they take to switch Medicare Supplement Plans, they have to add credible prescription coverage – Plan D Prescription Drug Plan – and pay monthly penalties based on the amount of time they went without coverage. Here is Medicare’s example of calculating penalties. Read our previous post on Calculating the PDP Late Enrollment Penalty here.

A few more important points to help you understand Plan J and Credible Prescription Drug Coverage:

- Dropping Plan J does not enact a Special Election Period, as the Part D coverage associated with it is not considered to be credible.

- Prescription Drug penalty will be paid in addition to monthly Prescription Drug Plans and Medicare Supplement Plan premiums.

- The Medicare Advantage Trial Right option above is not eligible if they have ever had a Medicare Advantage plan in the past

Understanding these points are important for you to give your customers accurate information so they can make an informed decision. As always, our Agent representatives are here to help!