Medicare may give people access to medical coverage, but there are still many expenses that beneficiaries are responsible for. These expenses can add up from monthly premiums, co-pays, co-insurance, and prescription drug costs. For beneficiaries with limited income and resources, this can be a burden and prevent them from getting the care they need. People on limited incomes could get help paying for Medicare costs through Medicare Savings Programs. This is a huge benefit that helps them stretch their income and gain access to more care that they could otherwise not afford.

What is the Medicare Savings Program?

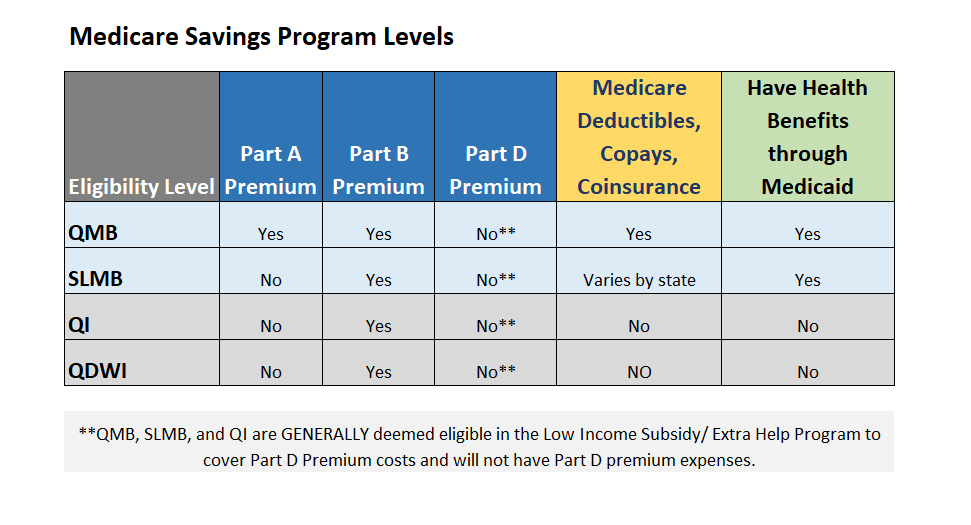

Medicare Savings Programs (MSPs) are administered by Medicaid for people on Medicare who have limited income and resources. For those who qualify, MSPs will pay their Medicare Part A and Part B premiums, and depending on their eligibility level, they may also help pay their other out-of-pocket Medicare expenses. These expenses can include Medicare Part A (Hospital Insurance) and Medicare Part B (Medical Insurance) deductibles, coinsurance, and copayments.

What are the coverage levels?

MSP levels can vary by state and not all of these may be available in each state, but generally there are 4 kinds of Medicare Savings Programs that this blog will cover.

Qualified Medicare Beneficiary Program (QMB)/ Full Dual Eligible

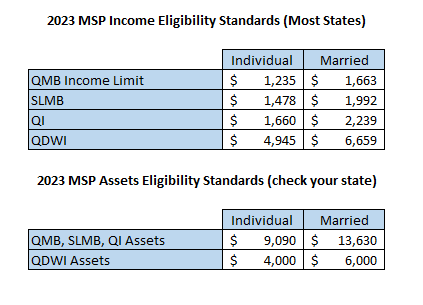

This Program is limited to individuals who meet the federal poverty level (+$20) and an asset limit requirement that can vary by state (see grid below for 2023 poverty income levels). The federal poverty level can change each year. Some states, like Arizona, do not have an asset requirement. QMB helps pay for qualifying beneficiaries’ Medicare Part A premiums, Part B premiums, and deductibles, coinsurance, copayments, and the Part B penalty. QMB will also pay the premium for Part A if you haven’t worked 40 quarters. If you do not have Part A but meet QMB eligibility guidelines, your state may have a process to allow you to enroll in Part A and QMB. Many states allow this throughout the year, but others limit when you can enroll in Part A. Generally, most QMB eligibles are considered full duals, which means they have health benefits through both Medicaid and Medicare and can enroll in a Dual Special Needs Plan and have no out-of-pocket Medical expenses.

Specified Low-Income Medicare Beneficiary Program (SLMB)

The SLMB Program is for those whose monthly income falls between 100-120% of the poverty level (+$20), with individual income above the QMB level. SLMB helps pay for qualifying beneficiaries’ Medicare Part B premiums and the Part B penalty. In some states, SLMB includes Medicare deductibles, coinsurance, and copayments.

Qualified Individual Program (QI)

The QI program allows for an individual to have a little more income than QMB or SLMB to qualify. The income limits are between 121-135% of the federal poverty level (+$20). Those who qualify under the QI program receive help paying for their Medicare Part B premium. Like the other programs, they will also pay any Part B penalties.

Qualified Disabled and Working Individuals Program (QDWI)

QDWI is for people who are under age 65, disabled, and no longer entitled to free Medicare Hospital Insurance Part A solely because they successfully returned to work. They can qualify for QDWI if they continue to have their disabling impairment, sign up for Part A, and have an individual income limit of $4,945 and a resource limit of $4,000 in 2023 for most states. QDWI program will pay for Part A premium.

How to apply for MSP?

Generally, applications for the Medicare Savings Programs are submitted through the local Medicaid agency. In Arizona, for instance, this is the Arizona Health Care Cost Containment System (AHCCCS). The Medicaid offices will generally have multiple ways to apply: by phone, online, or a printed application. You can also start application process for MSP by completing the Low-Income Subsidy application for Part D Extra Help. If you chose so, it will also send in your MSP application.

To qualify for Medicare Savings Programs, a person must have Medicare Part A and their income and resources must fall within the eligibility level for each level of coverage. These levels are set at a federal level, but each state can raise or eliminate these levels. For instance, 9 states (AL, AZ, CT, DE, MS, NM, NY, OR and VT) and DC have eliminated the resource test for all of the MSPs. Here is a better breakdown of the eligibility limits.

The MSP Application

It is important to call or fill out an application if you think you can qualify for savings – even if your income or resources are higher than the amounts listed. This could be because some resources or income may not be counted, and some states eliminate the resource limits.

In general, countable resources include:

- Money in a checking or savings account

- Stocks

- Bonds

In general, countable resources don’t include:

- Your home

- One car

- Burial plot

- Up to $1,500 for burial expenses if you have put that money aside

- Furniture

- Other household and personal items

In all states, the following income is not counted:

- The first $20 of your monthly income

- The first $65 of your monthly wages

- Half of your monthly wages (after the $65 is deducted

- Food stamps (Supplemental Nutrition Assistance Program (SNAP) support)

Remember, states can vary on how they income or assets are counted. Some states exclude more of your monthly income than the examples listed above. Check with the state’s Medicaid office to determine local limits.

MSP Approval, now what?

Once a beneficiary is awarded an MSP level, they will also automatically qualify for Part D Extra Help to help pay for prescription drug costs. See more on Extra Help and how it works in our latest blog, The Ins and Outs of Extra Help. Eligibility for MSP is generally re-determined each year and if your income increases or decreases you can move up or down the levels.

Enrollment Options/ Periods for MSP

The assistance received from the Medicare Savings Program also applies to enrollment in a Medicare Advantage plan. Qualifying for any MSP allows a beneficiary to enroll, change, or drop a plan outside of Medicare’s Annual Election Period (AEP). Using a Special Election Period, beneficiaries who qualify for MSP can make a change once each quarter during the first 3 quarters of the year. These are the 3 quarters outside of AEP. A change for any given quarter is based on the submission date, and not the effective date for the quarter. So, if a beneficiary submits an enrollment application for a plan change in April with a May 1st effective date, then they would have to wait until July to submit a new enrollment application with an August 1st effective date. They can also make a change during AEP with an effective date of January 1st.

Aside from these quarterly changes, they can also add or change a plan if they have any change in their MSP status. This includes if they lose eligibility, gain eligibility, or if their eligibility level moves up or down the previous mentioned benefit levels.

Going from Medicaid then gaining Medicare eligibility

If an individual is already on Medicaid and then gains Medicare eligibility, then they will automatically be awarded MSP. Once they qualify for Medicare, the individual will no longer be covered under Medicaid for prescription drugs and will need to enroll in Part D. If they are Full Dual, then some states may automatically enroll them in a Dual Special Needs Plan, but they still have the option to make a change to a plan of their choice.

Learn more about other ways you can reach and help low income individuals save on Medicare costs in our blogs, The Ins and Outs of Extra Help and How to Market and Grow your Medicare Business with LIS and DSNP.

Feel free to contact us and learn more about how we can help you and your agency.

GMIA, Inc. – How to Market and Grow your Medicare Business with LIS and MSP Eligible Beneficiaries Says :

[…] Savings Program extremely well. For more in depth information on these programs, see our blogs The Ins and Outs of the Medicare Savings Program and The Ins and Outs of Extra Help, Low-Income […]