Medicare Supplements are a great product to add to your portfolio in order to increase your yearly income. Whether you’re an existing Medicare agent wanting to keep sales up outside of the Medicare Annual Enrollment Period, or if you are new to Medicare and looking for an easier path to start selling to Medicare recipients, you should learn the ins and outs of Medicare Supplements so you can effectively and consistently sell them.

What is a supplement?

A Medicare Supplement, commonly called Medigap, is an insurance policy issued by a private insurance company to people that are enrolled in Original Medicare. These are policies purchased to help cover the gaps in Medicare Part A and Part B coverage. As an agent, it is important to include Medicare Supplements in your portfolio because they can be sold year-round and you don’t have the same restrictions as Medicare Advantage Plans (MA/MAPD).

How is a supplement different from MA/MAPD plans?

Medigap is different from an MA/MAPD Plan because it is a policy issued in addition to Original Medicare Part A and Part B, in order to cover the gaps in coverage. Medicare Advantage, on the other hand, is issued in place of Original Medicare, commonly called Part C, and manages the coverage of Part A and Part B. Why is this distinction important? Since MA plans replace Original Medicare, they are assigned strict regulations and marketing restrictions, as well as more training and certification requirements for agents. Medicare Supplements, on the other hand are just what they are called: A supplemental insurance policy. Therefore, the regulations surrounding MA plans are not the same as on Medigap coverage since they are not considered “Part” of the Medicare Program.

What do Medicare Supplements cover?

While there are many different levels of Supplement coverage available, they are intended to help cover some or all the deductible and co-insurance with Medicare Part A and Part B. Let’s first look at the out-of-pockets expenses that are associated with Original Medicare without any supplement policy.

|

Part A: Hospital and inpatient deductible |

You pay:

|

|

Part B deductible and coinsurance |

Deductible is $240 in 2024. After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you’re a hospital inpatient), outpatient therapy, and Durable medical equipment (DME) |

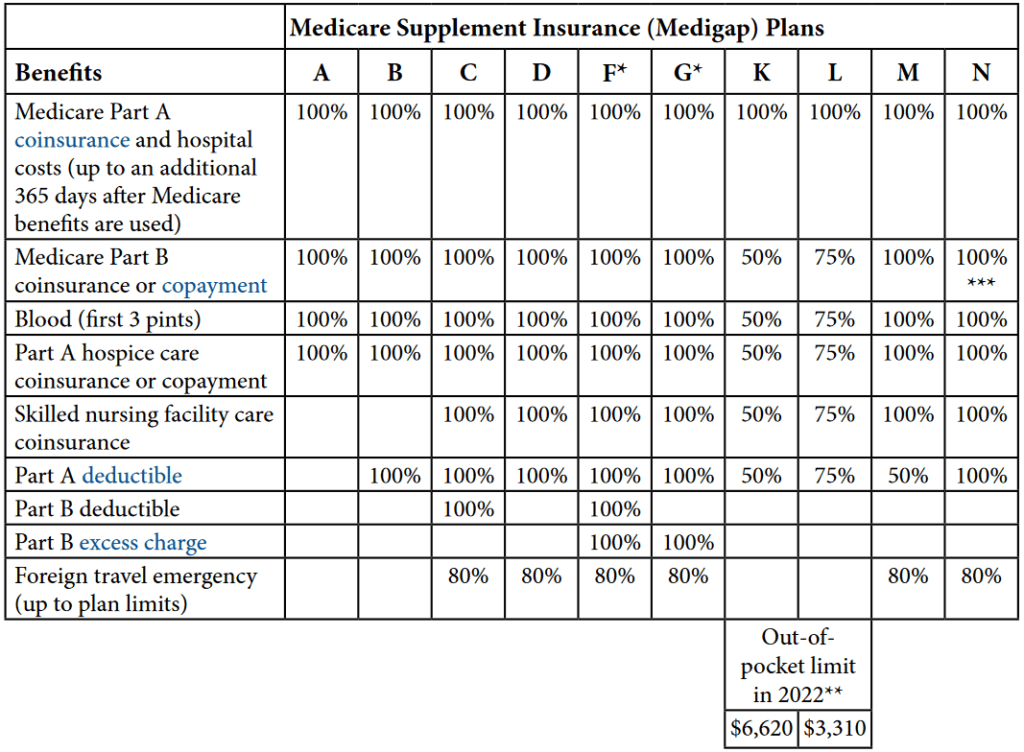

As you can see, Original Medicare leaves the beneficiary with plenty of opportunity to rack up out-of-pocket expenses between initial deductibles and co-insurance. Medicare Supplements can help reduce these expenses. Depending on the date the beneficiary becomes eligible, as well as their state of residence, there are up to 10 standardized supplement plans to choose between. Each plan with a different level of coverage. Here is a breakdown of the different plans and how they cover the gaps in Original Medicare.

*Excess Charges are the difference between what Medicare has established for reimbursement and the charges by a doctor who does not accept Medicare assignment.

Some Supplement plans include extra discounts and services in addition to the standard coverage listed above. For instance, some may include membership for Silver Sneakers program or meal delivery after an overnight hospital stay.

Important note on Plan F and C changes in 2020: As part of the MACRA changes, Congress is eliminating Plan F and Plan C, which cover the Part B deductible for “newly eligible” Medicare Beneficiaries starting January 2020. This means that anyone who becomes eligible for Medicare Part B starting January 2020 will not be able to purchase a Plan F or Plan C. Anyone who becomes eligible before January 2020 can still enroll in these plans, even after January 2020 as long as they became eligible before January 2020. For more information on these changes, read our latest blog on “MACRA Changes to Medigap Policies for 2020”

What don’t they cover? There are a few things that Medicare Supplements do not typically cover. Medicare supplements do not cover:

- Long-term care in a nursing home,

- Dental,

- Vision,

- Hearing aids, or

- Private-duty nursing.

Do Supplements include Part D coverage?

According to the Medicare Prescription Drug, Improvement, and Modernization Act of 2003, all Medicare recipients must obtain a Medicare Part D Prescription Drug Plan (PDP) when they received their Part A in order to avoid any Part D Penalties. Within this act, any drug coverage associated with a supplement plan is not considered credible coverage. Specifically, see our past blog on Medicare Supplement Part J’s drug coverage HERE.

This means that anyone enrolling in a Medicare Supplement will also need a stand-alone PDP to satisfy the “credible coverage” requirements. If not, they may be subject to the Part D penalty if they do not have any other form of credible coverage. We go into more detail about this on our blog “What is the Prescription Drug Penalty.”

When are you eligible to enroll in a Medicare Supplement?

In order to enroll in a Medicare Supplement, the recipient must be enrolled in both Medicare Part A and Part B. The best time to enroll is during the recipients open enrollment period because they are given guaranteed issue without going through traditional medical underwriting. However, unlike MA/MAPD plans, they are eligible to purchase a supplement anytime of the year as long as they can pass underwriting. Here is a brief look at the different enrollment times and whether they require underwriting:

OPEN ENROLLMENT | Guaranteed Issue/ No Underwriting | A beneficiary open enrollment period runs for 6 months, starting from the time they first become eligible for Part B. Generally, this is when they turn 65. However, if they continue to receive credible employee coverage after turning 65 they can delay their Part B and their new Open Enrollment pushes out to the time they finally lose their employer covered, credible health coverage. |

Rest of the year | Underwriting Required | You can add a policy any time of the year if you are on Original Medicare Part A and B, and do not have an MA/MAPD Plan. However, in these circumstances you will be subject to Medical Underwriting. |

Guaranteed Issue | No Underwriting | There are few events that give you Guaranteed Issue Rights when you are outside of your Open Enrollment. See the Guaranteed Issue Rights below. |

What and when are Guaranteed Issue Rights?

Guaranteed Issue Rights give Medicare recipients the right to purchase a supplement plan without Medical Underwriting. During this period, an insurance company that issues supplements cannot refuse to sell you a policy, charge you more than someone else with no health problems, or make you wait for coverage. Under this circumstance, there are no underwriting questions and the recipient will automatically receive the preferred rate.

As mentioned above, Guaranteed Issue is automatic during the open enrollment period. Other instances include the following:

You have a guaranteed issue right if… | You have the right to buy… | You can/must apply for a Medigap policy… |

(Trial right) You joined a Medicare Advantage Plan (like an HMO or PPO) or Programs of All-inclusive Care for the Elderly (PACE) when you were first eligible for Medicare Part A at 65, and within the first year of joining, you decide you want to switch to Original Medicare. | Any Medigap policy that’s sold in your state by any insurance company. | As early as 60 calendar days before the date your coverage will end, but no later than 63 calendar days after your coverage ends. Note: Your rights may last for an extra 12 months under certain circumstances. |

(Trial right) You dropped a Medigap policy to join a Medicare Advantage Plan (or to switch to a Medicare SELECT policy) for the first time, you’ve been in the plan less than a year, and you want to switch back. | The Medigap policy you had before you joined the Medicare Advantage Plan or Medicare SELECT policy, if the same insurance company you had before still sells it. If your former Medigap policy isn’t available, you can buy Medigap Plan A, B, C, F, K, or L that’s sold in your state by any insurance company. | As early as 60 calendar days before the date your coverage will end, but no later than 63 calendar days after your coverage ends. Note: Your rights may last for an extra 12 months under certain circumstances |

Your Medigap insurance company goes bankrupt and you lose your coverage, or your Medigap policy coverage otherwise ends through no fault of your own. | Medigap Plan A, B, C, F, K, or L that’s sold in your state by any insurance company. | No later than 63 calendar days from the date your coverage ends. |

You leave a Medicare Advantage Plan or drop a Medigap policy because the company hasn’t followed the rules, or it misled you. | Medigap Plan A, B, C, F, K, or L that’s sold in your state by any insurance company. | No later than 63 calendar days from the date your coverage ends. |

Underwriting Medicare Supplements:

Whenever you sell a Medicare Supplement policy without a Guaranteed Issue status, then the application will need to go through Medical underwriting. This includes multiple health questions on the application and a Medical Records Release Form. Once in underwriting, the application decision can be one of three outcomes: It can be approved at the Preferred Rates, approved at the Standard Rates, or Declined. Each company varies on what they consider when approving or declining a supplement, but conditions that generally get a decline decision are for major medical conditions such as:

- End Stage Renal Disease,

- Cancer,

- Advanced Diabetes with complications,

- recent major heart attack or stroke,

- Alzheimer’s Disease,

- or admitted to inpatient hospital stay/skilled nursing facility in the last 90 days.

Underwritten Medicare policies could be subject to a potential 3-6 month waiting period for pre-existing conditions if they did not have prior insurance coverage. Due to the uncertainty of underwriting, if your customer is switching from an MA/MAPD or switching from a different Medicare Supplement plan then make sure they hold off on canceling until the underwriting decision comes through. This way, if they get declined for any reason then they will have their old coverage to fall back on. If they get approved, then make sure they cancel their old plan.

Medicare Supplement Policy Costs

Medicare premium costs are determined based on the plan, company, and rating method used for that state. Plans that cover more benefits (i.e. Plan F and Plan G) are going to cost more than plans that cover less or have a high deductible. There are 3 different rating methods for Medicare Supplements, which depend on the state where the beneficiary resides:

Community rating: Policyholders pay the same premium within a given plan, regardless of age. Insurers can raise premiums only if they do so for all policyholders of the given plan type.

Issue-age rating: Premiums are based on the age of the policyholder at the time of purchase but cannot increase automatically in later years based on his/her age. However, the premium can increase yearly due to inflation, regardless of age.

Attained-age rating: Premiums are based on the age of the policyholder at the time of policy start date and increase each year as they age. In addition, the premium can increase yearly due to inflation, regardless of age.

Regardless of which rating system is used, insurers may still adjust premiums based on other factors, including nicotine usage, gender, and state of residence.

If you want to add Medicare Supplements to your portfolio, CONTACT US HERE to learn more about how we support our agents and help them start selling.

Comments are closed.